TL;DR - This isn’t financial advice, everyone should do their own research. With that in mind, consider mixing up the selection of assets and funds you buy, and once you buy your Stocks or ETFs you should forget about them for a while.

As an employee at an investment firm, I often get asked questions like “What stocks should I buy?” and “What is a good investment right now?” While it’s flattering to be asked for investment advice, there is no easy answer. Everyone’s financial goals, circumstances, and potential withdrawal timeline (such as for retirement) are different, so it’s difficult to recommend specific stocks without knowing more about an individual’s situation. In general, it’s not ideal to invest in individual stocks, and there are other habits and practices, such as periodic rebalancing, that can be more beneficial to focus on. In this post, I will summarize some principles that can be useful for making investment decisions. I may write more in-depth posts on each of these principles in the future.

Diversify your investments

Diversification is key when it comes to investing. Don’t put all your eggs in one basket by betting on a single company’s stock, even if you think you know a lot about it. Unless you’re a high-level executive in a monopoly-run industry, you’re unlikely to have an edge. Several studies have shown that investment professionals cannot reliably beat the market; even those who have huge portfolios, lots of data, and an army of employees working for them struggle to outperform the market. Consider instead investing in an index Exchange Traded Fund (ETF1) that tracks a broad set of companies instead.

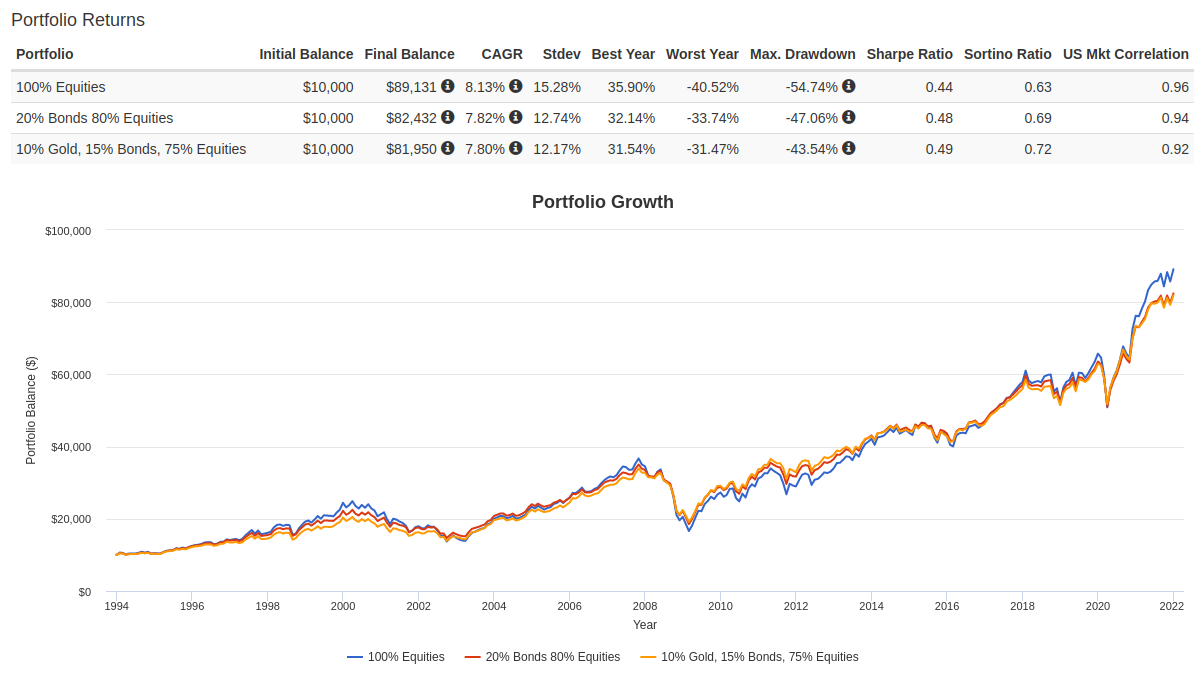

Diversification is one of the few, if not the only, sure things when it comes to investing. This goes for the stocks you buy, as well as the other asset classes you mix them with. In the long run, it’s not effective or necessary to invest 100% of your money in equities (shares). Despite what you may initially think, being fully invested in equities does not necessarily yield the best financial outcome. This has been proven and reaffirmed in finance academia for decades. Investing in both bonds and equities can provide diversification, as they often move in opposite directions. When you lose money on shares, you may be able to make some money on bonds. This can be seen in the comparison of the three portfolios below…

- Portfolio 1 Blue Line: 100% Equities

- Portfolio 2 Red Line: 20% Bonds, 80% Equities

- Portfolio 3 Yellow Line: 10% Gold, 15% Bonds, 75% Equities

This is what the growth of USD 10,000 looks like from 1994 to today. In general, you make the same gains (mostly) but with the addition of Bonds (the blue line), or Bonds & Gold (the yellow line) the growth is more stable; even higher during some periods. This shows up in the “Sharpe Ratio” on the table of figures, which is a metric that helps investors determine how much reward they’re getting versus how much risk they’re taking. Higher is better. You can see from the figures in the image that Equities + Bonds (0.48), or Equities + Bonds + Gold (0.49) has a higher Sharpe Ratio than just 100% Equities (0.44). This thinking of adding more assets to increase the efficiency of your portfolio comes from financial economics theory, which you can read up on if you like 2. In general, it’s good to split your portfolio into asset classes, such as Equities, Bonds, and Gold. Give these assets a % allocation of your portfolio, like 10%, or 80%.

Go for cheap options

You’re now ready to start putting some money to work in the market. You’re feeling pretty good about yourself, you’ve done your research, and you’re ready to buy some shares of that ETF you’ve been reading about. But before you do, there’s one thing you need to be aware of: costs. Costs can come in all of shapes and sizes, from brokerage fees to transaction charges and more. And while they might not seem like a big deal at first glance, they can actually be a huge drag on your investment performance. Here’s why:

Let’s say you decide to buy $1,000 worth of shares in that hot new tech company. You’re feeling pretty smart, and you’re ready to watch your money grow. But before you can buy those shares, you have to pay your broker a $15 fee. So instead of investing $1,000 you’re only investing $985. Now, let’s say you hold onto those shares for a five years and they do really well. You make 10% per year, which is a good return. But remember that $15 fee you paid upfront? That’s eating into your returns. Instead of making 61% in total for the full period, you’re only making 59%. Over time, those fees can really add up and take a big bite out of your returns. That’s just for one transaction at the very start as well!

So what can you do to avoid investing costs and make the most of your money? One option is to use a low-cost or no-cost brokerage that offers no-commission trading or has low fees. You can also consider using index funds or ETFs that track a basket of securities, rather than buying individual stocks. This can help to reduce your trading costs and diversify your portfolio.

And finally, one of the best ways to avoid investing costs is to simply hold onto your investments for the long term. The more you trade, the more fees you’ll pay. So if you can resist the temptation to buy and sell all the time, you’ll keep more of your money working for you. In the end, investing costs may not seem like a big deal at first, but they can really add up over time and eat into your returns. By being aware of these costs and taking steps to minimize them, you can help to maximize the amount of money you have invested.

Rebalance your positions regularly

Over time, the value of your portfolio’s investments may change. For example, a 60/40 allocation of equities and bonds may grow to 82/18 or even fall to 50/50. To keep your portfolio aligned with your original allocations, you should periodically rebalance your investments by buying or selling to bring them back to their original levels.

For example, if you invested $100,000 in a portfolio with 10% gold, 15% bonds, and 75% equities (like Portfolio 3 in the previous section) in 1972, and then forgot about it for 50 years, the value of your investments will have changed significantly. By 2022, your position in US equities would have grown from 75% to 95.2%, while gold and bonds would make up only 5% of your assets. This would result in a 50-year Sharpe ratio of 0.53. Your “max drawdown,” or worst loss at any point during this period, would be -44.84%, which occurred during the financial crisis from 2007 to 2009.

If you rebalance your holdings back to their original allocation percentages (10%, 15%, and 75%) once a year, you would end up with a 50-year Sharpe ratio of 0.56, which is slightly better than the 0.53 we saw earlier. Your max drawdown, however, would be much better, at only -37.85%, compared to -44.84% from before. If you were planning to retire during the 2005 to 2010 period, this difference in max drawdown could have made a significant impact to the value of your retirement fund just when you began to rely on it for income.

Don’t overthink it

After choosing your assets and purchasing your ETFs, mark your calendar for when you need to check and rebalance your portfolio, and then leave it alone. Avoid checking it too frequently, as it can be stressful and counterproductive unless you are a professional investor or trader. Instead, let your portfolio do its thing. If you want to deposit more money or rebalance your portfolio, that’s fine, but otherwise, try to forget about it for a while. It’s also not necessary to keep your broker’s app on your phone unless you use it for two-factor authentication.